Texas Government Exceeding Constitutional and Biblical Spending Limits

Part One of a Series Examining the 89th Texas Legislature

State Funds Spending Up $25 Billion

Over the weekend, one of the last acts of the 89th Texas Legislature before it adjourned sine die was to adopt the Texas budget for the 2026-27 fiscal biennium. The results were not good for Texas taxpayers.

Few people are aware that budget consists of two bills: Senate Bill 1 and House Bill 500. SB 1 is known as the appropriations bill for the upcoming 2026-27 biennium, and HB 500 is known as the supplemental appropriations bill that traditionally has filled in any funding gaps for the current biennium (in this case, 2024-25). However, most of the taxpayer money appropriated in HB 500 will likely be spent in the 2026-27 biennium. This is because most of the $14 billion appropriated in HB 500 can be spent during “the two-year period beginning on the effective date of this Act.” Meaning it can be spent through about early June, 2027.

Because of this budget deception and the way it is used to hide the increase in spending from one biennium to the next, we will examine the Texas budget using a much more straightforward approach that the methodology used by the Texas Legislature’s Budget Board (LBB): comparing how much the Texas Legislature appropriated this session compared to how much it appropriated in 2023. This is by far the most accurate way to assess the growth of Texas government spending.

Figure 1 shows that the Texas Legislature appropriated $251.3 billion in state funds this session. This is $25.7 billion higher than 2023, an 11.4% increase. This contrasts with the real but manipulated numbers in the official budget documents released by the LBB which show an increase of $10.9 billion, or 4.8%.

This focus on state funds spending, rather than total spending—which includes federal funds, also helps give Texans a better picture of how well the Texas Legislature is stewarding their money. The underlying reason for focusing on state spending is that state funds are the only funds that the Texas Legislature has full control over. Federal funds come and go, and the Legislature often uses this feature to manipulate the numbers to hide spending increases. An example: with the end of federal COVID-19 funding, appropriations of federal funds this session are down more than $5 billion, making the increase in total spending look better compared to the increase in state funds. Thus, in addition to examining session-to-session spending to get an accurate picture of the Texas budget, it is also useful to examine the appropriation of state funds. As we see above, the 11.4% two-year increase is not good from a taxpayer perspective.

The 2026-27 Texas Budget Exceeds the Constitutional Tax Spending Limit

One reason that the LBB manipulates these numbers is that it allows the Texas Legislature to exceed the Texas Constitution’s Tax Spending Limit in Article VIII, Section 22 which prohibits spending growth of some state funds to increase faster than the growth of the Texas economy. The growth limit for this session is 8.93%. While the state funds measure used in Figure 1 is broader than the funds that are limited by this limit, the outcome is the same. The LBB’s growth estimate is lower than the 8.93% limit, but the actual growth of state funds appropriations accurately determined is likely higher than the limit.

The LBB says that state spending in SB 1 comes in $10.3 billion under the Tax Spending Limit. Yet if about three-quarters of the “two-year spending” in HB 500 is spent in the 2026-27 biennium, the Legislature would be in violation of the Tax Spending Limit—if the numbers were accurately accounted for.

Additionally, the spirit of the Tax Spending Limit is being violated through other appropriations made by the Legislature. It is appropriating $5 billion into the Energy Fund (SB 1) and $2.5 billion into the Water Fund (HB 500). Under the provisions of previously passed legislation, these funds will immediately become constitutionally dedicated, and because of this, they do not count towards the Tax Spending Limit. No voter approval or special legislative vote is needed to make this happen.

Adding this $7.5 billion to the as much as $14 billion of “two-year spending” that is being improperly shifted backwards into the 2024-25 biennium, it is easy to see that the Texas Legislature is violating the spirit, and perhaps also the letter, of the Texas Constitution’s Tax Spending Limit. This highlights a flaw in the design of the constitutional structure of the limit; it puts a legislative agency, the LBB, in charge of guarding legislative spending. Of course, in the eyes of the Texas Legislature, this is a feature, not a bug. For taxpayers, however, it would be better if the Texas Comptroller was watching over this, just like it does for the Pay-As-You-Go Limit, which prohibits deficit spending by the state.

The 2026-27 Texas Budget Exceeds Biblical Tax and Spending Limits

One of the problems with humans, including those in civil governments, is that we want usurp God’s authority. This was the problem with Eve who desired knowledge so she could “be like God” (Genesis 3:5). It was also the problem with the people of Babel who wanted to “make a name for ourselves” (Genesis 11:4). And it is the problem with most civil governments today, including Texas government.

One way we might determine whether leaders in Texas government are “kissing the Son” (Jesus Christ) and serving Him with fear and trembling (Psalm 2:11-12) is to determine whether the state is confessing God in its public policies.

There certainly have been some improvements in Texas in the last few years; we should be grateful for this. Yet while tens of thousands of Texas babies are still being murdered with the abortion pill, the Texas Legislature refused to pass legislation to stop that. The Legislature did define man and woman in law this year, but failed to pass a bill that would have required the biological sex of a child to be put on his birth certificate—and remain there despite the gender preference of the individual. The state has moved to end DEI teaching and programs in many areas, but it still awards state government contracts of more than $4 billion a year based on the color of the contractor’s skin or her sex. We have a way to go before Texas law and policy comports with God’s Word.

Another, more quantitative, way of determining whether Texas government wants to take the place of God is to examine its taxing and spending practices. Generally, a civil government that sets a tax rate exceeding 10%, the tithe that God requires (Genesis 14:19–20, etc.), or imposes taxes to fund activities that are not in accord with its biblical or constitutional responsibilities, reflects the character of man rather than of God and sees itself as a rival to God (Douglas Wilson)

Tax Freedom Day is the day on which America has collectively worked enough to pay its federal, state, and local tax obligations. It is generally in April, about one-third of the way into the year. Thus, American government at all levels take about one-third of Americans’ increase, far beyond what God requires for Himself.

What about Texas? In 2022, personal income for Texas was just over $2 trillion, while Gross State Product was $2.4 trillion. The tithe using those measurements would be $200 billion and $240 billion, respectively. Yet total state and local revenue from non-federal sources was about $257 billion. Either way you measure it, Texas governments were collecting more than 10% of Texans’ incomes. And given the fact that spending of state funds in the 2026-27 budget is up 54% over just the last four years, it is highly likely that Texas is still demanding more from its citizens than God does, especially considering the entire tax burden, federal, state, and local, should be less than 10%.

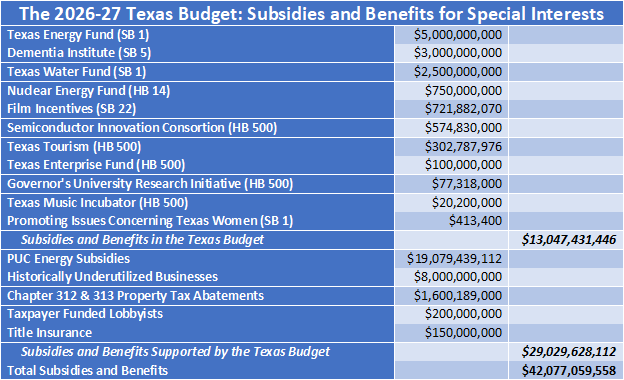

Texas also spends a lot of money taken from Texans on things that have no warrant from a biblical perspective. For instance, there is more than $42 billion of corporate welfare contained in or supported by the Texas budget that is essentially a transfer of wealth from some Texans to other, more highly favored or well-connected Texans. Some might argue that some of the spending in the chart below has a biblical warrant, but even taking out a few billion here and a few billion there still leaves plenty of tax dollars that the state should not be collecting.

Conclusion

There is simply no way, constitutionally or biblically, to justify the amount of money Texas government will spend over the next two years. Or to justify what it will be spending much of the money on. Texas’ political leaders and voters must come to grips with the fact that we have built a government that seeks to usurp God and become all things to all people in our state. We must collectively repent, seek God’s forgiveness, and abandon this edifice we have built, just like God forced the people of Babel to abandon their tower.

Your mistake is thinking that they actually believe in any god other than themselves.